Why Real Estate Remains a Steady Investment, Even When the Market Wobbles

In times of economic uncertainty, watching the stock market can feel like riding a rollercoaster blindfolded. One day your portfolio is thriving, the next it’s taken a dive. If you've been checking your 401(k) or brokerage account lately, you're not alone in feeling uneasy.

But if you’re a homeowner, or thinking about becoming one, there’s good news: real estate behaves very differently from stocks.

📞 Call Ina Now

Unlike stocks, which are known for sharp ups and downs, home values tend to move at a steadier pace. According to Investopedia:

“Traditionally, stocks have been far more volatile than real estate... stocks are more prone to large value swings.”

And the data backs this up.

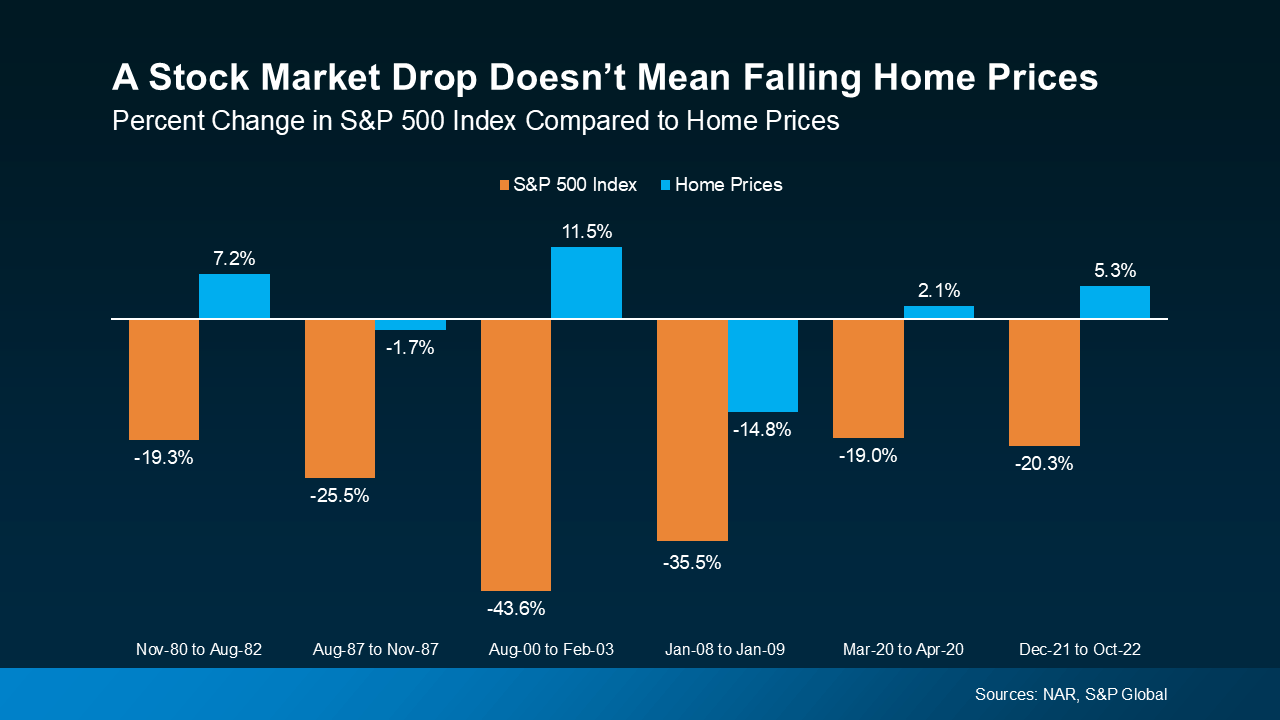

📉 A Stock Market Drop Doesn’t Mean Falling Home Prices

Just take a look at the chart above. It compares home price trends (in blue) to stock market drops (in orange) across several major downturns. Even when the S&P 500 took a major hit, home prices often stayed steady, or even climbed. The 2008 housing crash was a unique situation driven by risky lending and oversupply, not the norm.

That’s a crucial reminder: the real estate market isn’t automatically tied to the stock market.

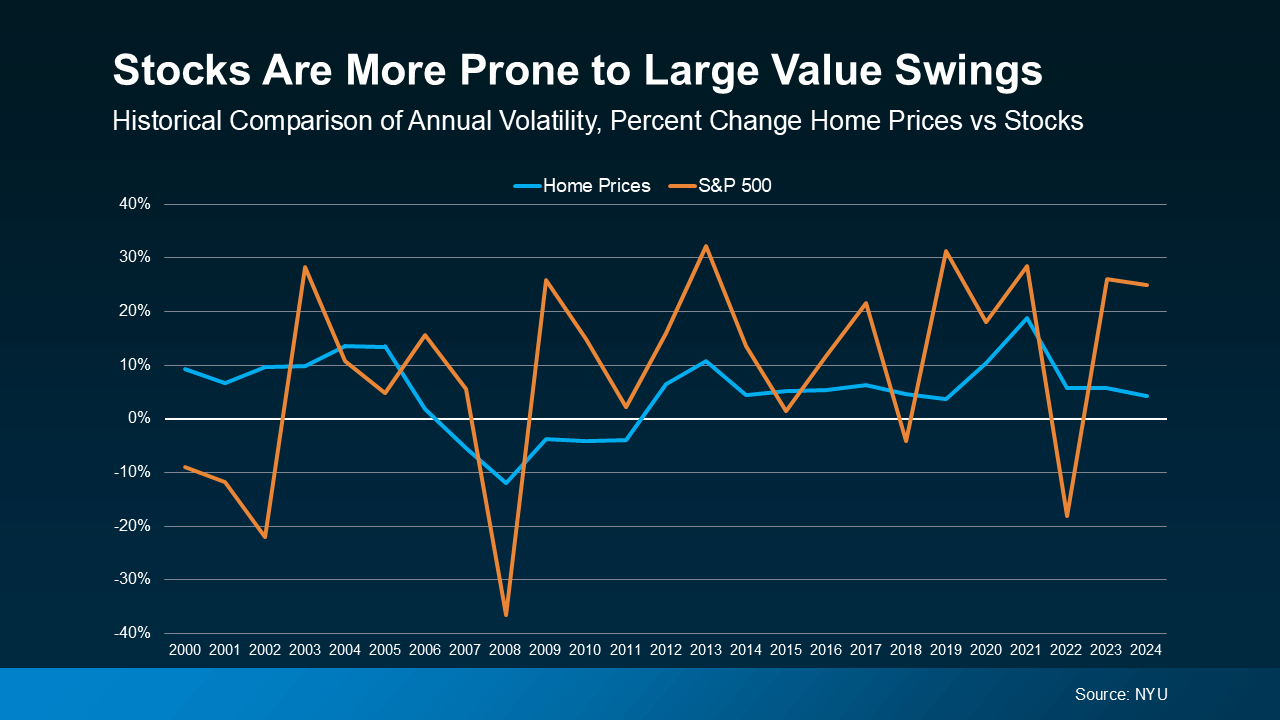

📊 Real Estate Is Less Volatile Than Stocks

This second chart shows annual percentage changes for both home prices and the S&P 500. Notice how the orange line (stocks) swings wildly year to year, sometimes gaining or losing over 30%. Meanwhile, the blue line (home prices) follows a gentler, more stable path.

That’s why owning a home can offer a strong sense of financial security, especially when the markets feel uncertain.

The Takeaway: Long-Term Confidence in Homeownership

If recent stock market swings have left you feeling nervous, take heart: your home isn’t likely to follow that same unpredictable pattern. Real estate continues to be one of the most reliable long-term investments available.

Bottom Line

Market ups and downs may come and go, but your home is more than just a place to live — it's a financial asset that tends to hold its value, even when other investments falter.

👋 Thinking about your next move? Let’s talk strategy. Whether you’re buying, selling, or simply weighing your options, I’ll help you make confident, well-timed decisions in any market.

Categories

Recent Posts

GET MORE INFORMATION