What’s Ahead for the Housing Market? Here’s What to Expect in the Second Half of 2025

Is Now a Smart Time To Move? Here’s What the Experts Are Saying.

Between easing mortgage rates, a surge in housing inventory, and shifting buyer behavior, it’s no wonder people are asking: Should I make a move right now, or wait it out?

The short answer: there’s opportunity in this market — but you need the right strategy to take advantage of it.

Let’s break down where things stand right now, and what to watch as we head into the final stretch of 2025.

1. Mortgage Rates Are Easing, and Incentives Are Getting Better

Rates aren’t plummeting, but they’re finally offering some relief. As of this month, the average 30-year fixed mortgage rate sits at 6.58%, the lowest since October 2024. That’s down from the 6.7%+ levels we saw earlier this year.

Even better? Certain new-home builders are offering special financing with rates as low as 3.75% for qualified buyers. That’s pulling more buyers back into the market who had been waiting on the sidelines.

If you’d like to know which builders are offering the strongest incentives right now, reach out, I’ll point you in the right direction.

Bottom line: the rate shouldn’t be the dealbreaker anymore. The real advantage goes to those who are informed and ready to act when the right property — and the right numbers — line up.

2. Inventory Has Jumped, Especially in Las Vegas

Nationally, supply has been climbing, but Las Vegas is in a league of its own. As of now, the valley sits at a 20.83-week supply of homes — that’s nearly five months of inventory, compared to the razor-thin 4–6 week supply we saw in past years.

More choices mean buyers finally have breathing room and sellers can consider a move-up or downsize without feeling “stuck.” But with competition rising, presentation and marketing are no longer optional — they’re essential.

3. Home Prices: Steady Overall, but Balancing Out

Prices remain surprisingly resilient. Over the summer, Las Vegas saw median home prices bounce between $485,000 and $440,000, reflecting normal seasonal shifts rather than a crash.

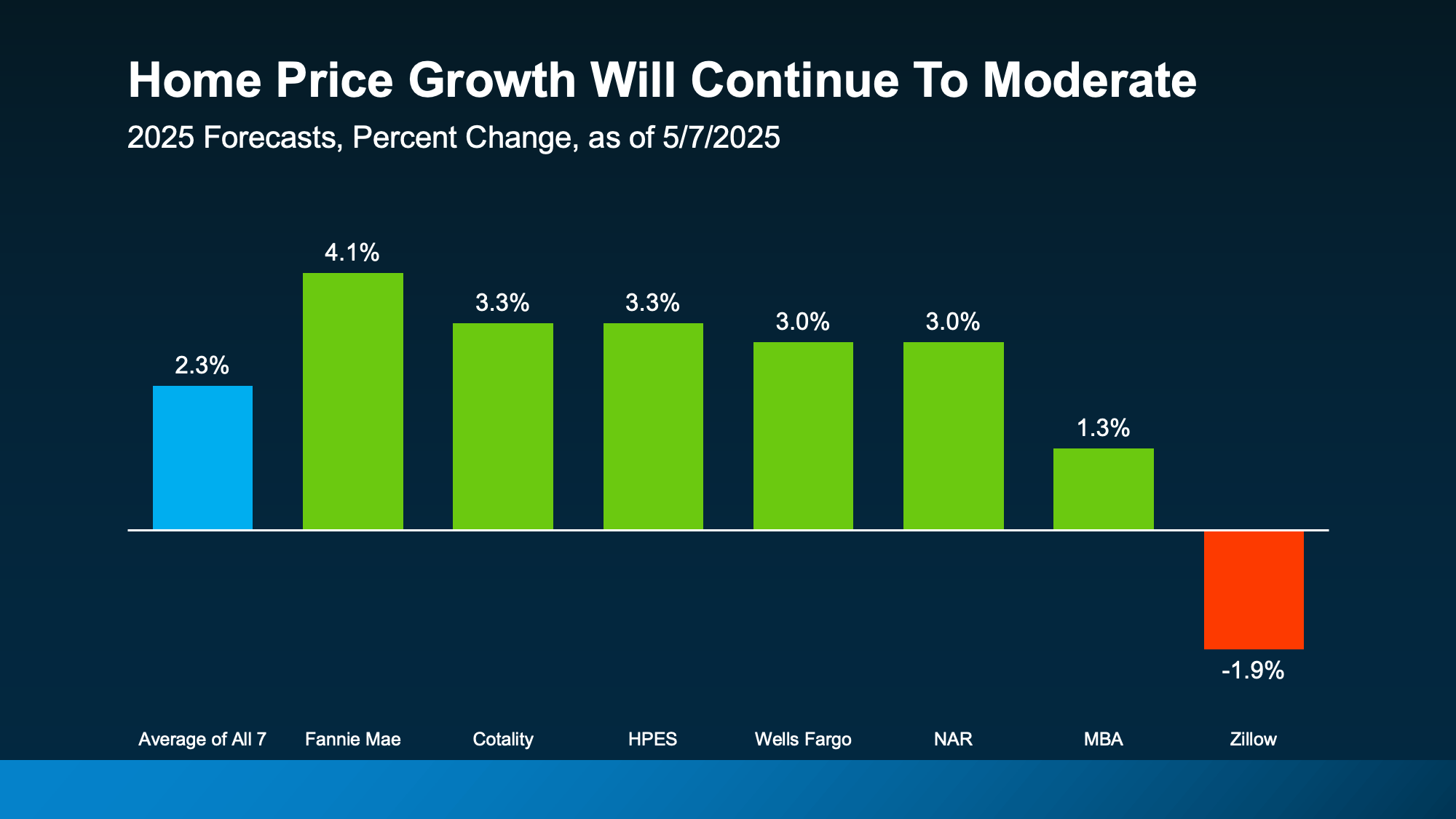

Experts predict home price growth will moderate in 2025, with most forecasts calling for modest gains between 2–4%. The fundamentals — population growth, limited land, and investor interest — remain strong.

4. The Market Pace Has Shifted

We’ve entered a more balanced market than we’ve seen in years. With inventory at nearly 21 weeks and sales volumes lighter than last year, homes that are priced right and marketed well are still moving — but it’s no longer “anything sells overnight.”

This is where strategy matters. The gap between homes that sell and homes that sit is widening.

So… Should You Move Now?

If you’ve been waiting for the “perfect” market, here’s the truth: there’s no such thing. But right now, we have a rare mix of more choices for buyers and steady demand for well-positioned homes. That’s a window worth paying attention to.

-

If you’re considering buying: you have more leverage, more options, and in some cases, builder incentives you haven’t seen in years.

-

If you’re considering selling: you can still achieve a strong price — but it takes pricing precision and standout marketing. You’ll see exactly what I mean when you click through to the next page: 🔗 Marketing Your Home at the Highest Level — where I show you how I position homes to move in any market.

Categories

Recent Posts

GET MORE INFORMATION